A U.s. Federal Government Budget Surplus Occurs When

As a result the shortfall budget causes aggregate demand to fall. A budget surplus occurs when income exceeds expenditures.

U S Government Budget Surplus By Quarter 2021 Statista

A federal budget surplus.

. It is rarer than a unicorn. Government revenue exceeds outlays. A federal government would have budget surpluses if total tax revenues are more than the government spending.

Government spending covers a range of services provided by the federal state and local governments. This is federal spending that is included in a budget if Congress wishes. Learn vocabulary terms and more with flashcards games and other study tools.

A budget surplus is more beneficial to a government. Government outlays exceed revenue. There is a surplus budget if tax receipts exceed spending by the government.

A balanced budget occurs when the amount the government spends equals the amount the government collects. Suppose that over the past 50 years the nominal and real deficit of a country grew from 100 billion to 200 billion. 16 When a government increases its budget deficit then that countrys.

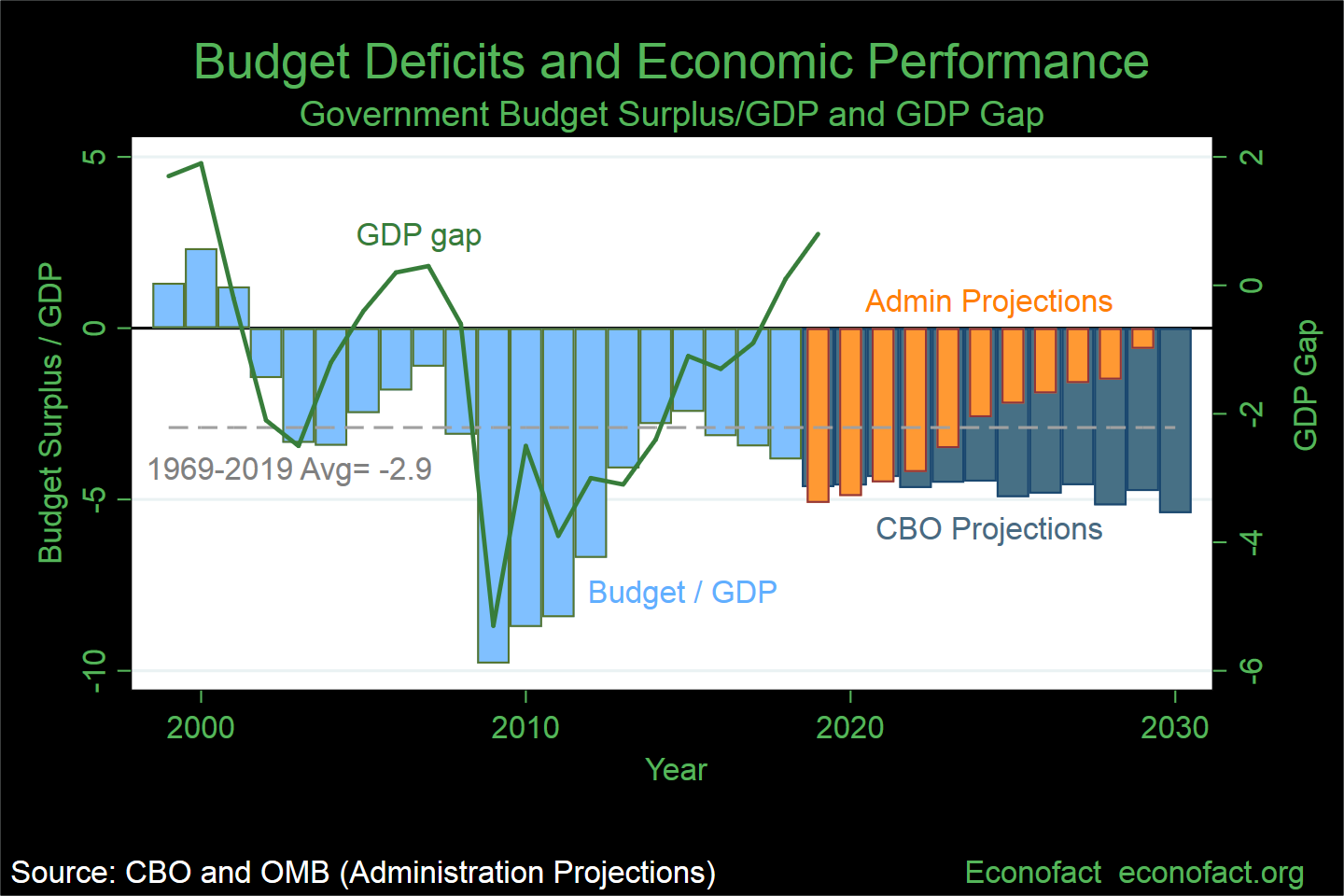

Corporate income taxes are taxes paid by firms to the government from their profits. A budget deficit occurs when government receipts are less than spending and a budget surplus occurs when government spending is less than receipts. The last surplus for the federal government was in 2001.

The opposite of a budget deficit a budget surplus occurs when the governments revenue exceeds current expenditures resulting in an excess of money that can be used as needed. The federal government has managed to run a surplus in just 2 years since 2000 and 9 years since 1950. A budget of this nature can be useful if inflation persists or the overall output exceeds its level of aggregate demand.

For interest paid to US. Start studying Microeconomics Ch 15. A budget surplus is a situation in which revenue is more than spending or income is more than the expenses in a given period like a fiscal year or a financial quarter.

The United States lends money to foreign countries. 14 How do governments finance deficits. Budget surpluses are not always beneficial as they can create deflation and economic growth.

Is under the direct control of congress. Fiscal policy refers to. - A budget surplus occurs when the governments expenditures are less than its tax revenue.

The deficit or surplus in the federal governments budget if the economy were at potential GDP. Typically to either 10 per cent or 15 per cent. Tax treaty generally reduces the withholding tax rate to nil.

Government outlays equal revenue. Government has run a multibillion-dollar deficit almost every year in modern history spending much more than it takes in. Tax revenues or receipts are the money a government collects through a tax.

It is having more income than the expenditure during a specific period. 17 What is the impact of. Cyclically adjusted budget deficit or surplus - Cyclically adjusted budget deficit or surplus.

Occurs when tax revenues exceed government expenditures. It is worth noting that budget surpluses are quite rare in the past 120 years. Budget Surplus This occurs when tax revenue exceeds government spending.

A surplus occurs when the government collects more money than it spends. A budget surplus is when extra money is left over in a budget after expenses are paid. When the government has a budget surplus.

When the federal government spends more money than it receives in taxes in a given year it runs a budget deficit. The opposite of a budget deficit a budget surplus occurs when the governments revenue exceeds current expenditures resulting in an excess of money that can be used as needed. A budget deficit occurs when the federal government spends more money that it collects in revenue.

During the 1800s the federal government reported a surplus in 69 years and a deficit in 31 years. A budget surplus occurs when government tax receipts are greater than government spending. Budget 2022 proposes to introduce amendments that would affect the way in which withholding tax rates apply to certain stripped interest coupons.

Suppose that over the same time real GDP grew from 100 billion to 300 billion. It means the government can either save money or pay off existing national debt. A balanced budget occurs when the amount the government spends equals the amount the government collects.

15 How does a government budget deficit surplus affect the economy. A payroll tax also known as social insurance tax is a tax on the wages of workers. The last surplus for the federal government was in 2001.

Federal government budget surplus occurs when. A surplus occurs when the government collects more money than it spends. 12 When the government begins to run a budget surplus.

The United States borrows money from foreign countries. A federal budget deficit. A budget surplus occurs when tax revenues exceed government spending.

Changes in government expenditures and taxation to achieve particular economic goals. Budget surpluses are not necessarily bad or good but prolonged periods of surpluses or deficits can cause significant problems. In fact the government has recorded budget surpluses in only five years since 1969 most of them under Democratic President Bill Clinton.

A budget surplus occurs when government brings in more from taxation than it spends. Occurs when government expenditures exceed tax revenues. After that deficits became far more common occurring in 70 years of the 20 th century.

An advantage of a consumption tax over the present income tax system is that a consumption tax discourages consumption and encourages saving. 13 When the US federal government runs a budget deficit it borrows money by selling. A federal budget surplus occurs when government expenditures exceed tax revenues.

The President S Framework For The Budget Surplus What Is It And How Should It Be Evaluated

Comments

Post a Comment